Focused Practice

Family Law, Criminal Defense and Personal Injury

Because the law is simply too vast for any attorney to truly master all practice areas, our firm has adopted a practice model in which each member focuses his or her attention on a specific area of law. This allows us to stay on the cutting edge of developments in our respective practice areas and to provide expert counsel to each and every client we represent.

Quality Representation And Honest, Straightforward Advice

Weisberg & Weisberg, PLLC has been representing the citizens of the Hampton Roads area in criminal, family and personal injury matters for several years. We understand the stress and emotion that accompany serious legal challenges, and we are known for providing honest, straightforward advice and excellent representation to every client we serve.

At our first meeting, you will find that we listen intensely to the facts and circumstances of your case and your goals. One of our attorneys will advise you of the law surrounding your case in a way that you can understand. We will also give you an honest assessment of the reasonable likelihood of accomplishing your goals, and we will map out a practical approach to your case.

Contact us today at 757-659-9611 for a free consultation on your Criminal or Personal Injury matter.

While we have enjoyed much success with our clients’ cases, we are a firm that will not make you false promises or sugarcoat the issues in your case. We pride ourselves in telling you what you need to hear, even if it is not necessarily what you want to hear.

We look forward to the opportunity to speak to you about how we can put the considerable resources of our firm to work for you.

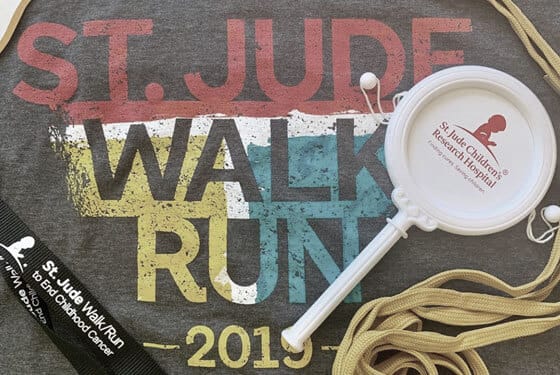

Giving Back

At Weisberg & Weisberg, we believe that we have a responsibility to do our part to make the world a better place, and that is why we are committed to giving back to the community we serve. From supporting a variety of local and national charities, to making small changes to support our environment, and representing underserved members of our community, we are committed to giving back to the community that gives us the privilege of representing it.

Contact Us To Discuss Your Legal Matter

Read Noah’s

Biography

Noah Weisberg

Partner & Founder

More

Read Amy’s

Biography

Amy Weisberg

Partner & Founder

More

Read George’s

Biography

George Gorman

Attorney

More

Read David’s

Biography

David Scott Dildy

Attorney

More

Read Jeremiah’s

Biography

Jeremiah Asercion

Attorney

More

Read Jaimee’s

Biography

Jaimee Park

Attorney

More

Rob’s

Biography

Rob Asercion

Attorney

More

Let's Do This Together

Contact Weisberg & Weisberg, PLLC, in Newport News, to discuss your legal matter in confidence with one of our lawyers. We welcome the opportunity to serve you and your family.